How to Read the Largest Number of Shares Traded

Once you've done your research, you may have decided on an investment that'due south correct for yous. Before y'all start trading, information technology helps to have some knowledge of how buying and selling securities like stocks and exchange-traded funds (ETFs) works.

We'll walk you through some of the key things to know about placing trades — including the bid and inquire section of a stock quote — and describe iii of the virtually common types of orders.

Bid and Enquire

Like any marketplace, there are two sides to every trade: a buyer and a seller. A buyer submits a bid, which is the highest price they're willing to pay for a security, while a seller submits an inquire, which is the lowest price they're willing to take.

Buyers and sellers each besides submit the number of shares they are willing to purchase or sell. At that place is oft a long list of buyers and sellers waiting to have their orders filled at different prices.

Spread

The difference betwixt the bid and the inquire is called the spread. Sometimes the spread tin can exist quite wide. At other times, the deviation may be no more than than a penny. In general, more liquid securities — those that merchandise more than ofttimes in higher volumes — volition have a narrower spread.

Size

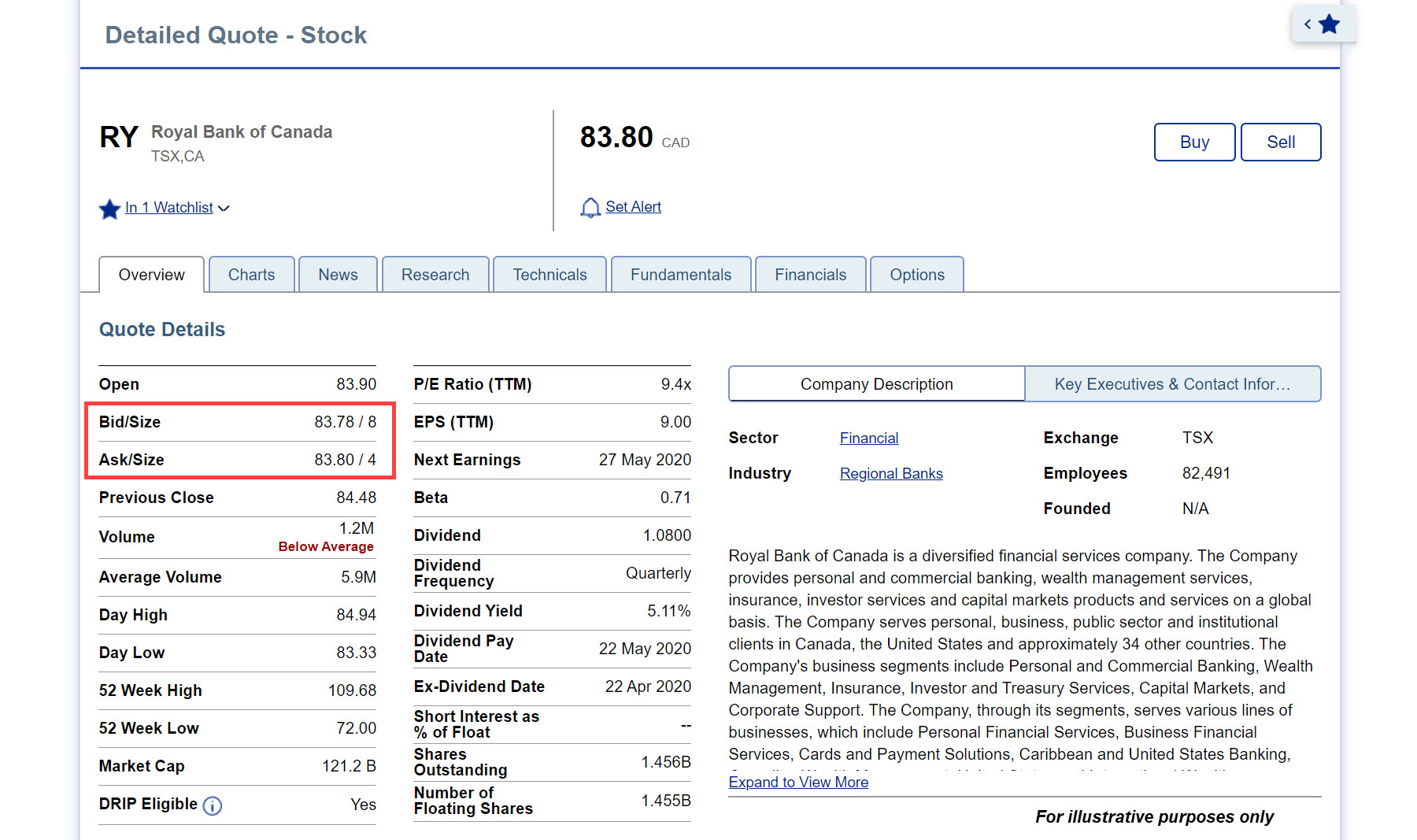

The number of shares bachelor at the bid and ask price is referred to equally size, and can exist found alongside the bid and ask in a detailed quote.

Here where you'll find each:

Size is counted in board lots. A lath lot is a standard number of shares that'south determined based on two things: the exchange where the security trades and the stock cost. More often than not, a lath lot for stocks priced at $1 or more than is equal to 100 shares. If you trade a number of shares that's not a total board lot, it is referred to as an odd lot.

| Lath Lot Size | TSX & TSX Venture |

| 100 | stocks priced at $i.00 and over |

| 500 | stocks priced at $0.10 to $0.99 |

| 1,000 | stocks priced nether $0.10 |

Stocks trading on the NYSE and NASDAQ priced at $ane.00 or higher generally have board lots of 100 shares. Large-dollar-value stocks may trade in smaller board lots.

Picket Video: How to read a stock quote

Society Types

Here are the most popular types of trades and how they work.

1. Market order

When you identify a market place social club to buy or sell a security, you don't specify a price and your society volition typically be executed immediately at the best available price.

Here's an example:

You lot're buying 1,000 shares of a security. The best enquire toll is $5 for 300 shares. The adjacent best ask cost is $5.fifty for 2,000 shares. Your market place social club would first snap up the 300 shares at $5. The remaining 700 shares would be filled at $v.50. Your average cost would be $5.35, plus any applicative commission/fees.

PRO: With a market order, information technology'southward likely that your order will exist filled quickly during trading hours.

CON:When placing market orders, prices may vary widely, especially on thinly traded stocks. Yous could be surprised past the price you end up with, even with a heavily traded security. Sometimes toll movements are fast and volatile.

If yous're ownership or selling a heavily traded stock with a narrow spread, the departure in price is unremarkably minimal. Withal, thinly traded securities with wide bid/ask spreads could result in you paying or receiving a price that's significantly different than what you expected based on the last trade price.

REMEMBER:If you lot place an order when the market is airtight, your order is probable to exist filled when trading resumes on the next business organisation mean solar day. A lot can happen overnight, and a stock may offset trading at a much higher or lower toll from where it closed the previous solar day.

2. Limit order

When you place a limit club to buy or sell a security, you state the maximum cost you are willing to pay when buying (or minimum sale price when selling), along with the number of shares. Your gild volition be entered in the system and volition stay open until it is filled, cancelled or expired.

Here's an example:

A stock is trading at $21. You enter a limit order to buy it at $20. If the price continues to rising, your order may never be filled and you might miss a ownership opportunity. Even so, if the ask price drops to $20, your club would be partially or completely filled, depending on how many shares are available at that cost. Your social club could also be filled at a ameliorate cost since your limit lodge is the maximum toll y'all want to buy the stock for, but if the stock falls beneath that, yous could end upwardly with a lower cost.

PROS:You have control over the fill up toll. You lot can ready a "adept through" flow, which leaves your order open for a specified fourth dimension menses to wait for the toll to encounter your limit toll. On U.S. exchanges, you tin as well specify "any part" or "all or none," which lets the system know you're willing to accept a fractional make full if there aren't enough shares available to complete your lodge. Only "any part" orders are available on Canadian exchanges.

CON: In that location is no guarantee that your order volition be filled.

REMEMBER:If there'south a buyer or seller willing to meet your toll, your society will likely be filled at the toll you specified, or better. However, limit orders are offset-come, starting time-served. If other investors placed orders with the same limit cost earlier you, you're out of luck.

When deciding whether to identify a market place order or limit society, you need to decide what's more than of import: ensuring a speedy transaction or having command over the price.

3. Cease social club

Stop and stop-limit orders can be used to purchase or sell stocks when they hit a toll predetermined by you lot. Orders are triggered only if the cost of the security hits your chosen price before the order expires. The order that'due south triggered can be either a market or limit guild.

Here's an case:

You own 100 shares of Company XYZ. It is trading for $50, only you think the price is going to fall and want to sell if it does. Yous could place a stop-limit order with a end price of $45 and a limit toll of $44.

That means that if the price drops to your stop price of $45, the order to sell will exist triggered. In this case, your gild becomes a limit order to sell 100 shares at $44 or ameliorate.

PROS: You tin set your limit price to equal your stop price. Finish orders tin can be used if you are unable to monitor your portfolio for a menstruation of time, such as when you lot're on vacation.

CON: If the number of available shares is express or the market place is moving quickly, your order might not be filled.

Remember: When setting your terminate price, keep in mind that if you set information technology very close to the current price, it could be triggered by normal marketplace volatility rather than any visitor-specific motility in the price.

For Canadian markets, simply end-limit orders are accepted, not terminate orders. U.S. markets accept either stop or stop-limit orders. Terminate orders without a limit become market orders when triggered.

You can likewise place a stop club to buy a stock. For example, you retrieve the price of a stock is going up, you lot could identify a stop-limit society to purchase — setting the stop price higher up the current price. If the price goes up to the price you specify, a limit order to buy volition be triggered.

Watch Video: How to buy and sell a stock

View Legal Disclaimer

RBC Direct Investing Inc. and Majestic Bank of Canada are carve up corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Depository financial institution of Canada and is a Member of the Investment Manufacture Regulatory System of Canada and the Canadian Investor Protection Fund. Royal Banking company of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their ain investment decisions. RBC Straight Investing is a business organization name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Banking concern of Canada. RBC and Imperial Banking concern are registered trademarks of Regal Bank of Canada. Used under licence. © Imperial Bank of Canada 2019. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are but available in Canada and other jurisdictions where they may be legally offered for auction. If you are not currently resident of Canada, you should not access the information available on the RBC Directly Investing website.

henryressuffe1977.blogspot.com

Source: https://www6.royalbank.com/en/di/hubs/investing-academy/chapter/how-to-buy-and-sell-stocks/jv7atg15/jv7atg1j

Post a Comment for "How to Read the Largest Number of Shares Traded"